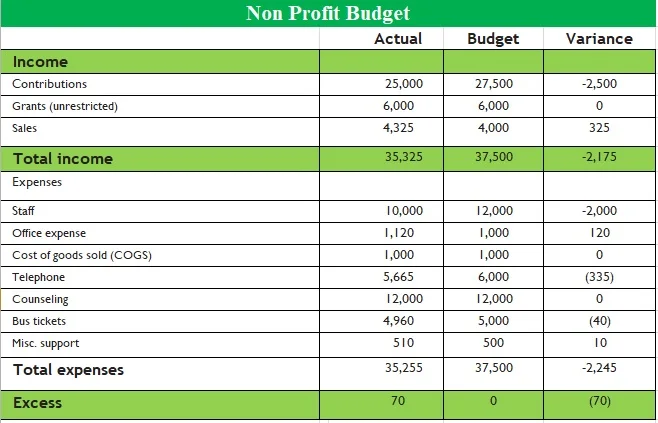

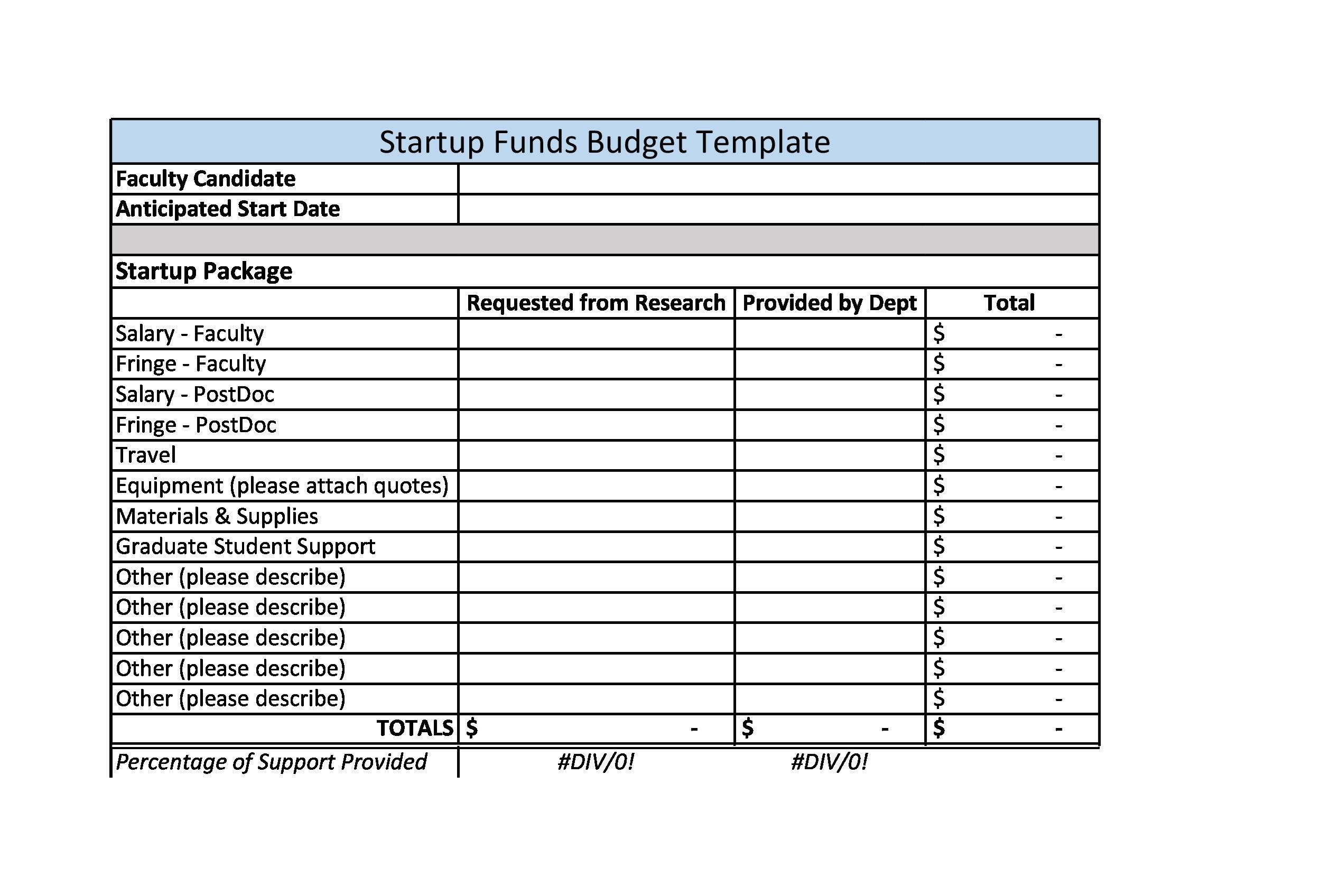

It’s important to create a budget that accounts for these costs and to set financial goals for the ways you will spend and save the money. As a start-up, you will likely have a multitude of startup costs that need to be covered. Estimating expensesĮstimating expenses is another critical financial goal. Additionally, savings can be used to fund research and development as you grow and scale your business. It’s important to have emergency savings in place to cover these costs and ensure you have enough money to keep your business afloat. As a start-up, you will likely face additional costs and ups and downs that come with running a business. Establishing savings goalsĪnother important financial goal is establishing savings goals. The money that you bring in from revenue provides money to pay startups costs and create a budget for yourself and the business. This goal is important because it sets the tone for all other financial goals. As you create and refine your business plan, you will practice projecting your potential earnings in the upcoming months or year of operation.

Establishing revenue goalsĪ primary financial goal should be establishing revenue goals. You need to set and manage your financial goals in order to properly manage your finances and ensure you have a successful start-up. Financial goals are your target objectives for the way you employ and manage your business budget.

When starting a business, setting the right financial goals from the start is critical.

START UP BUDGET HOW TO

How to Get Professional Advice to Reduce Start-Up CostsĪ budget is an essential tool for tracking your income and expenses.What to Put in Your Business Plan to Reduce Start-Up Costs.How to Analyze Market Trends to Reduce Start-Up Costs.The Hidden Costs of Launching a Business.

0 kommentar(er)

0 kommentar(er)